All Categories

Featured

Nonetheless, these policies can be much more complex contrasted to various other kinds of life insurance policy, and they aren't always right for each financier. Speaking to a skilled life insurance coverage representative or broker can help you make a decision if indexed universal life insurance policy is a good suitable for you. Investopedia does not provide tax obligation, financial investment, or financial solutions and guidance.

, including a long-term life plan to their financial investment profile might make sense.

Applied to $50,000 in financial savings, the costs above would amount to $285 per year in a 401(k) vs.

In the same veinVery same capillary could see might growth financial investment $7,950 a year at 15.6% interest with passion 401(k) compared to Contrasted1,500 per year at 3% interest, rate of interest you 'd spend $855 more on life insurance each month to have whole life entire. What Is Indexed Universal Life Insurance (IUL) and How Does It Compare to a 401(k)?. For the majority of individuals, getting irreversible life insurance as component of a retired life strategy is not an excellent concept.

Indexed Universal Life (Iul) Vs. 401(k): An In-depth Retirement Comparison

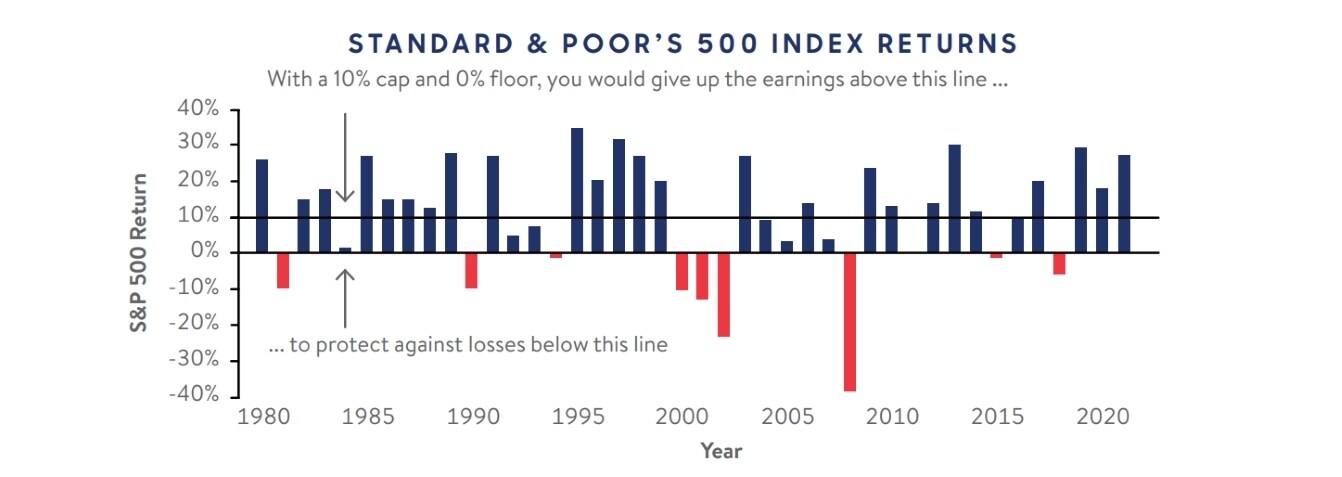

Traditional investment accounts generally provide higher returns and more versatility than entire life insurance coverage, but whole life can give a reasonably low-risk supplement to these retirement financial savings methods, as long as you're confident you can pay for the costs for the lifetime of the policy or in this instance, until retired life.

IUL insurance offers a range of benefits, making it a top choice for long-term planning. IUL for young families explained by agents. IUL is more than life insurance, combining protection with growth opportunities

One of the key benefits of IUL is its cash value growth. With tax-deferred growth, IUL policies are perfect for college savings or emergencies. Agents and brokers specialize in explaining IUL features, ensuring get the most out of your investment.

For families, Indexed Universal Life provides tax-free withdrawals, while business owners can use it for estate planning. With options like Indexed Universal Life for kids or wealth-building, there’s a policy for everyone. Speak with an insurance agent today to explore your options.

Latest Posts

Equity Indexed Insurance

Is Indexed Universal Life A Good Investment

Iul Retirement Pros And Cons